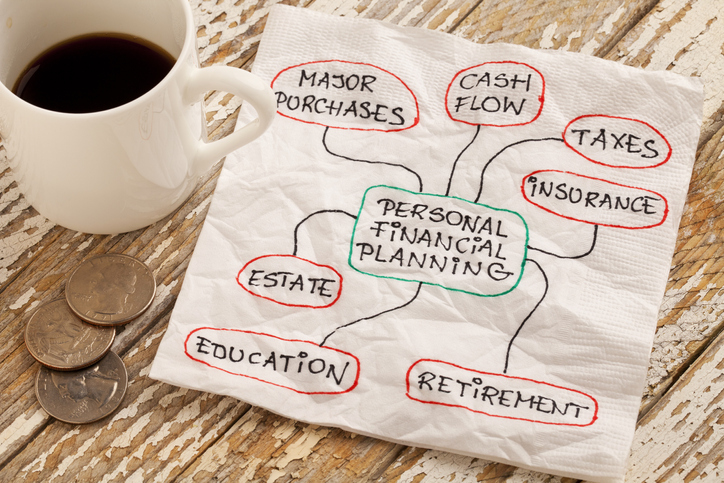

Personal

Tax Forms & Our Rates

Engagement Letters

We Love To Help People.

We agree that the U.S. Tax System can be complex with an ever-changing tax code landscape. Each year there are new as well as expiring tax rules to be applied.

We agree that the U.S. Tax System can be complex with an ever-changing tax code landscape. Each year there are new as well as expiring tax rules to be applied.

We help decipher the tax laws as they apply to your situation and develop tax reduction strategies so you pay the minimum tax you legally owe. .

We guide you through the complex decisions and make sure you understand how different financial decisions can impact your tax liability.

Our ultimate goal is for you to have clarity and to take better control of your finances and assets

We make sure you take advantage of all available deductions and credits to reduce your taxable income thus lowering your overall tax liability. These might include:

- Itemize Deductions

- Education Credits

- Retirement Beneftis

- Health Savings Accounts (HSAs)

- Homeowner Benefits

- Energy Efficient Home Improvements

- Child Tax Credits

- Self-employed Business Expenses

Be aware of how your investments impact your taxes. For instance, long-term capital gains are usually taxed at a lower rate than short-term gains. Additionally, certain retirement accounts offer tax advantages, so consider contributing to them.

Depending on your situation, you might benefit from deferring income to the following year or accelerating expenses into the current year to reduce taxable income.

Before the year ends we will consider when to incur expenses like - business, healthcare or investment losses. As well as plan the timing of income such as capital gains/dividends, bonuses, retirement contributions or Roth conversions.

Retirement may seem like a long way away but planning for it early can make an enormous difference in your comfort and quality of life.

Tax-advantaged retirement accounts are excellent vehicles for saving for retirement while enjoying potential tax benefits. We will consider these options that best suit your specific financial situation and retirement goals - 401& Solo (k)s, Traditional & Roth IRA's, SEP & SIMPLE IRAs.

Together we plan your resources efficiently to ensure you have the adequate funds for the life you desire after you retire.

Our planning will include:

- Identifying one's retirement needs.

- Determining how much money one needs to retire, comfortably -

- Managing assets before and during retirement.

- Making the most of one's employer-sponsored retirement plans & IRAs

- Determining when to take withdrawals

- How to inflation-proof one's investment income

- When should one begin taking social security benefits?

- How to plan for Health Care costs -

- Note - Medicare will not cover everything

Tax-efficient savings strategies help minimize the tax impact on your savings and investment returns. Depending on the vehicle, the goal is to legally reduce your taxable income, defer taxes, or take advantage of tax incentives. We use the vehicles below to create a personalized tax-efficient savings plan based on your specific financial situation and goals.

- Education 529 accounts

- Health Savings Accounts (HSAs)

- Flexible Savings Accounts (FSAs)

- Retirement accounts (401(k), IRAs, Roth IRA)

Money is only good here on this planet. Your wishes, your dreams, your legacy - is what drives your plan when you pass. Estate planning can help minimize estate taxes for heirs.

- How should your assets be distributed?

- Insure your minor children will be taken care of - appoint a guardian.

- Avoid probate - a lengthy, costly process that ties up your assets for a considerable amount of time.

- Health care directives - control your medical decisions by outlining your wishes regarding medical care should you not be able to communicate.

- Minimize family disputes

Selling investments at a loss to offset capital gains can be a strategic move to lower your tax liability.

Enrolled Agent (EA) is the IRS's highest credential for tax preparers.